I didnt really read what was written but I did promise to explain why Inflation with UBI is horseshit.

For people here who do not know how inflation happens, it is always a monetary phenomenon, ie fiscal stimulus or monetary policy - low interest rates. The amount of money in circulation gets far higher than what is produced which leads to more people bidding for the same thing( do not think people here are interested in monetary theory, money in circulation m1 m2 and those shits)

at least it was, for all the things in the 20th century, manufacturing was the main economic driver, you would have expansionary cycle and inflation would baloon, since most of the goods getting bought and sold were of that nature. In 21st century however, there has been a shift in these fundamental facts (though not all of them for the reasons which I will list later), even if you use ultra loose monetary policy and QE, inflation will literally not pick up at all(at least for the goods where its measured for). The reason for this has one answer, the ability to scale. In other words, economies of scale is when the cost of serving another customer are incremental, so instead of bidding against jeff for something, you may get it for lower price if jeff also buys it. So whereas before, if there was alot of demand, prices would go up since 2 people wanted 1 thing, now the demand is met with ease. This has been largely due to the nature of business models which are built around size, ie to serve more customers. (not a new concept but helps to explain how important it has become)

Think of most things you use, from hard products to internet(especially internet), netflix won't need to hire new team every time they have new subscribers, nor are the server costs much higher to serve an additional dude. Even if there is need, they can fill it with some 3rd country Emerging Market at virtually zero cost (the reason for their price hikes at netflix are very different from demand induced price hikes). One would make a case that when these subscribers are higher in number the service provider can actually lower prices, but that has been around for a while now (even if manufacturing plants used to hit capacity and then inflation would occur)

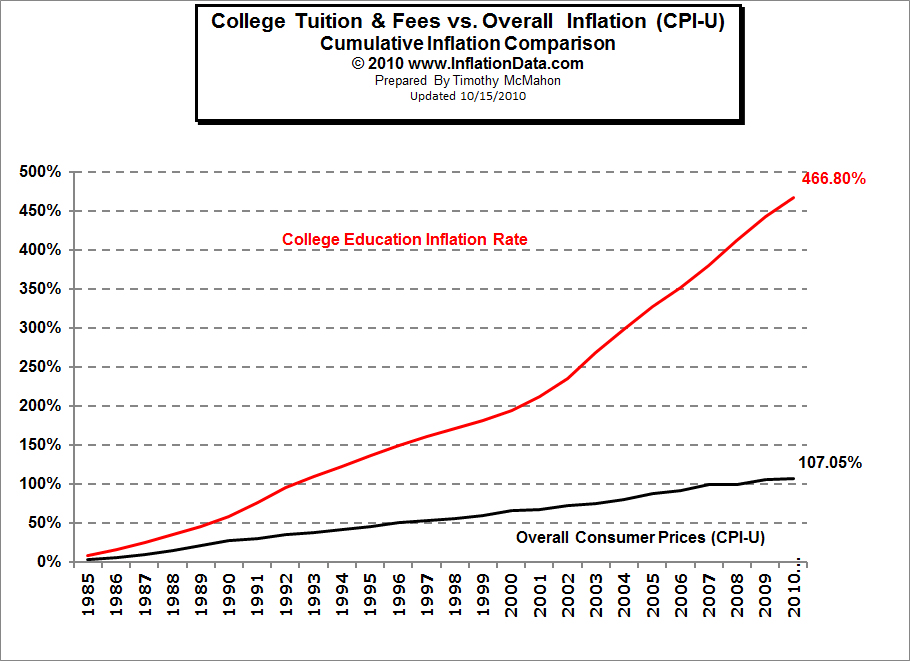

Now this explains why CPI is low, however, CPI does not include stuff that you can not scale, housing, medicine and especially lately education. So whereas if all of usa got netflix, that wouldn't lead to a price increase, however you give all of the bums in USA loans to study and this happens,

(there is a talk of packaging these shitty humanities graduates loans in same packages as fucking housing which lead to the crises but thats another topic. Also worth noting this picture is from 2010, in past 9 years this has gone way upwards, but its just to make a point)

So why does price of uni go up you ask? because if the university is at capacity, and everyone fulfills the GPA quota, it hits capacity, it can't take an unlimited amount of students, therefore they hike the price of tuition. Even if there was new universities to accommodate the new demand, the new universities would be like Trump University, with no history, shady as fuck and no one would pay money to study there (which is why the unis in top 100 are all 100+ year old, minus a few, that central european univeristy from hungary comes to mind and the 2 from saudi arabia i think). Which leads to inelastic demand and easy credit for medieval french sexuality and gender segregation studies. Another thing is the Housing bit, it is labor intensive, it has very limited supply potential (especially in countries like uk with strict house rules, tip: if you want to solve a housing crises, perhaps don't force people to live like fucking medieval noblemen) so when demand goes up supply can't meet it. Medicine as well gets expensive because if you and jeff are bidding for the same specialist, it won't lead to increase in supply (at least not in 30 years until a new specialist gets trained) therefore prices go up. Another is the patented goods (us has quite a flawed patent system but i think at times is necessary), leading to a very inelastic demand, and the sheer amount of money needed to discover new drugs.

How does this connect with UBI? Well in basic macro there are two metrics used to explain behaviour, Marginal Propensity to Consume and Marginal Propensity to Save. If you are rich you are more likely to save. However if you are a broke mf and get 1000 dollars from UBI this will lead to higher spending, which in turn (in theory in past) it used to lead to inflation. But i dont think anyone in here thinks that if 300 million americans signed up to netflix the prices would go up.. Which renders the point of inflation moot, there will probably never be that kind of inflation.

Now there is also another dimension to UBI. Usually it is thought UBI to be used to substitute all other social programs. So, thinking that would cause inflation, is foolish to say the least. The amount of UBI would be far less and far more efficient then a bloated beurocracy. Add to the fact that most of the future jobs will be done by robots or AI, unless we teach them to consume, they will not feel disappointed like humans do that someone else is getting paid while they do hard work, in a way they will be our servants, living to please us, therefore the conventional arguments against UBI are moot. The people instead will focus on universe and nuking mars, as we leave the robots to do the mundane shit. All the jobs that are getting automated, are jobs that people do not want in first place (ever met a happy truck driver?)

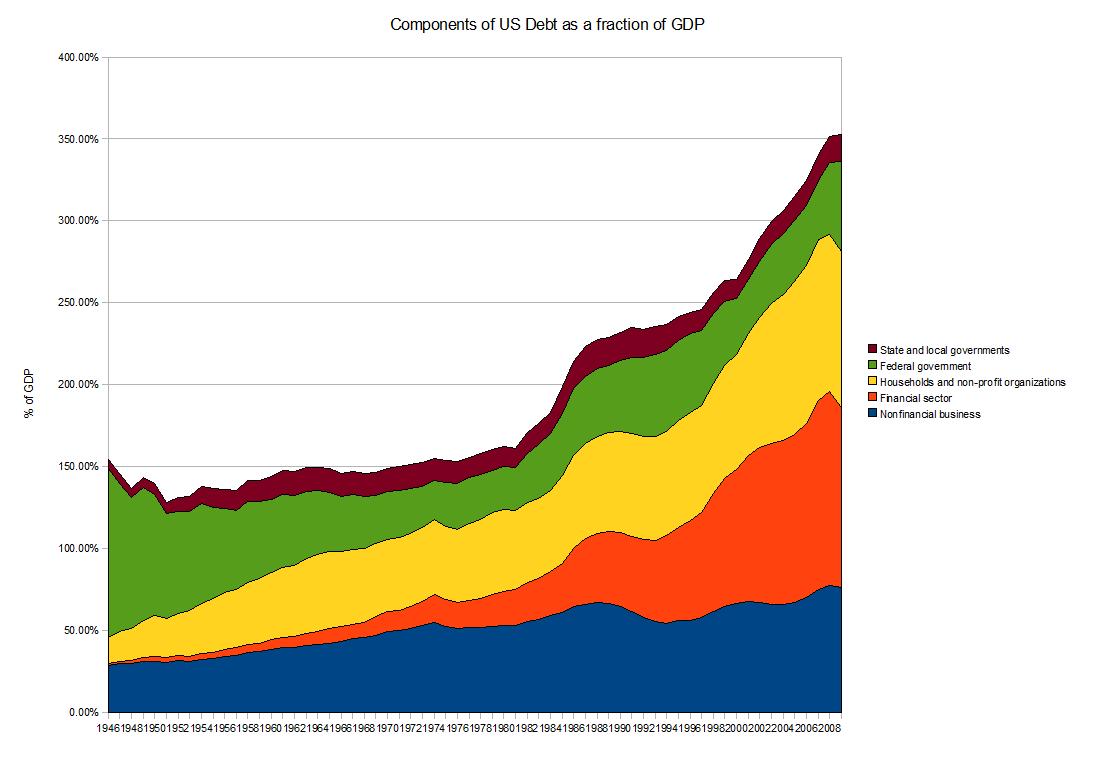

ps. I just read of QE and why it didnt cause inflation, governmental debt is only one part of the story, i dont wanna scare you guys but peep this.

and qe did lead to inflation, but not the one that would be detected by cpi, but it came in forms of higher valuation for firms due to increased M&A activity (leveraged loans hit record highs in 2018), the premiums paid usually were above 40% and that's at a time where s&p is at record highs...

10 years of FIF

10 years of FIF