You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stocks

- Thread starter J..

- Start date

- Joined

- Feb 14, 2007

- Messages

- 12,892

- Likes

- 6,806

- Favorite Player

- Il Capitano

Forum Supporter

Forum Supporter 10 years of FIF

10 years of FIFYeah, im sure expenses are crazy high in US. In Estonia $14k usd a year ,divided by 12 is average pay. 1100+eur. Getting that in dividend would be awesome.

- Joined

- Aug 2, 2007

- Messages

- 15,200

- Likes

- 2,499

- Favorite Player

- Cryptozo d King

10 years of FIF

10 years of FIF Most Diverse Poster

Most Diverse PosterLiving costs are different around the world. That might be nothing in US but it can be a lot in another country.

14k is a lot in the US but if you live in a major city it is not. My sister and her husband live in a 2 bedroom apartment in NYC. Its nice but nothing extraordinary her rent is $2,500 a month. Its funny because you walk 1 block away from her high rise and there is a park full of crack heads and projects everywhere.

I lived in Ohio for a few months my rent was $400 a month and was a bigger and nice place then what she got. I also lived in Dallas texas and it was super cheap to live there too. Right now my wife and I own a place in Boston. Mortgage is around 3k a month but its a 2 family and we rent out the bottom floor to grad students and one of the rooms in our floor to one of her friends.

- Joined

- Feb 16, 2013

- Messages

- 4,139

- Likes

- 501

- Favorite Player

- Eriksen

- Old username

- Jrg

Forum Supporter

Forum Supporter 10 years of FIF

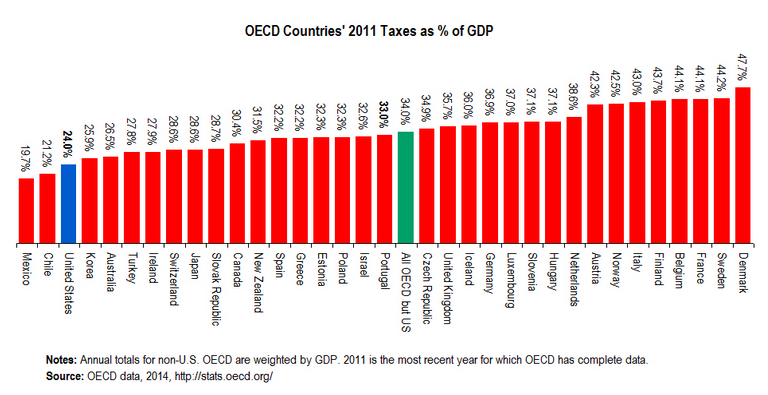

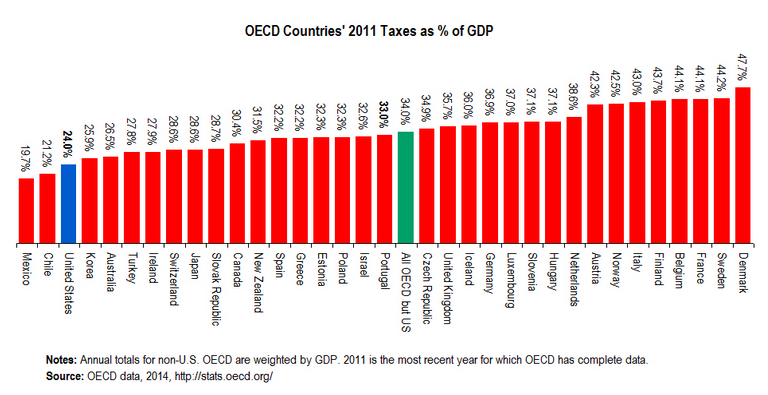

10 years of FIFGood old Denmark...

In terms of taxation of your income from stocks in Denmark:

Yeah we do have free health care, free schools, free universities, we do get paid by the state when we are studying ect. but it has a cost in terms of one having to pay a decent amount of your gains to the state.

In terms of taxation of your income from stocks in Denmark:

Since 1 January 2006, capital gains on quoted and unquoted shares have been taxed as income from shares at the rates in 2010 of 28% for gains up to DKK 48.300 (around 7000€) and 42% for the exceeding amount.

Yeah we do have free health care, free schools, free universities, we do get paid by the state when we are studying ect. but it has a cost in terms of one having to pay a decent amount of your gains to the state.

- Joined

- Nov 29, 2011

- Messages

- 7,465

- Likes

- 59

- Favorite Player

- Me

Forum Supporter

Forum Supporter 10 years of FIF

10 years of FIF14k is a lot in the US but if you live in a major city it is not. My sister and her husband live in a 2 bedroom apartment in NYC. Its nice but nothing extraordinary her rent is $2,500 a month.

I was gonna say that's cheap as fuck for NYC.

Its funny because you walk 1 block away from her high rise and there is a park full of crack heads and projects everywhere.

Until I saw that

- Joined

- Aug 2, 2007

- Messages

- 15,200

- Likes

- 2,499

- Favorite Player

- Cryptozo d King

10 years of FIF

10 years of FIF Most Diverse Poster

Most Diverse PosterHi guys saw this and thought you guys looking for stocks picks would like it Cramers 12 stocks (https://finance.yahoo.com/news/cramers-12-stocks-could-keep-234109564.html). I love watching Mad Money but basically by the time he mentions it, its probably too late.

Like I mentioned previously he mentions big blue chip companies that are 10-30% below their prices 1-2 years ago. Haha think I mentioned all these same companies. I just wouldn't suggest Apple or Cisco(if you want a cloud player go for MSFT or IBM).

I would stay the fk away from Apple tho. I am a huge Apple fan boy. I use to buy all their shit but they are the new Nintendo suck our dick or hit the road. Their computers are shit and now that Cell phone companies in the US will no longer pay most of your upgrade I doubt people will be getting new iPhones every year. 1-2 years ago the 2 year plan went away. The $200 new iPhone every 18 months is gone now instead its $30-50 bucks a month for a new iPhone for 12-18 months. They make nothing else ONLY FKING PHONES !! What if the iPhone 7 explodes like the Samsung one did. It will go from a $120 dollar stock to $30 buck stock instantly. Nothing in the pipeline.

Like I mentioned previously he mentions big blue chip companies that are 10-30% below their prices 1-2 years ago. Haha think I mentioned all these same companies. I just wouldn't suggest Apple or Cisco(if you want a cloud player go for MSFT or IBM).

I would stay the fk away from Apple tho. I am a huge Apple fan boy. I use to buy all their shit but they are the new Nintendo suck our dick or hit the road. Their computers are shit and now that Cell phone companies in the US will no longer pay most of your upgrade I doubt people will be getting new iPhones every year. 1-2 years ago the 2 year plan went away. The $200 new iPhone every 18 months is gone now instead its $30-50 bucks a month for a new iPhone for 12-18 months. They make nothing else ONLY FKING PHONES !! What if the iPhone 7 explodes like the Samsung one did. It will go from a $120 dollar stock to $30 buck stock instantly. Nothing in the pipeline.

- Joined

- May 14, 2013

- Messages

- 11,034

- Likes

- 7

- Favorite Player

- Skrinrar

Forum Supporter

Forum SupporterWell they have a huge amount of laptops which are overpriced but generally the optimal choice if you need to do any design or art stuff.

- Joined

- Aug 2, 2007

- Messages

- 15,200

- Likes

- 2,499

- Favorite Player

- Cryptozo d King

10 years of FIF

10 years of FIF Most Diverse Poster

Most Diverse PosterWell they have a huge amount of laptops which are overpriced but generally the optimal choice if you need to do any design or art stuff.

80% of their computers haven't been updated in 2 years. iTunes pissed off most major movie studios that's why digital copies are all Ultraviolet and not iTunes when you buy a blu Ray. iTunes is not 4K, list goes on. Apple only has the iPhone and its previous cool factor let's pay 20% more for their product that is quickly fading. The Mac Pro a 4,000 computer hasn't been updated in over 3 years!!! At least give it new chips!!!

- Joined

- May 22, 2004

- Messages

- 10,278

- Likes

- 3,348

- Favorite Player

- Oba

10 years of FIF

10 years of FIFOk so i have not really made my picks for 2017 since i usually reevaluate my portfolio in march/may since now i m busy with taxes and getting tax forms ready for my clients. Plus this year i already made a big shift in my portfolio after the trump election.

Generally speaking I expect markets to largely move side ways in this coming year. I dont expect the markets in general to make to big a again or a loss this year. Mainly because the situation in europe is still very unstable and also in the US many investors are still uncertain what a trump Presidency will mean. On top of that the feds interest rate increases was very modest plus the ecb will have to keep it s rate low because of a still struggling Europe so i dont expect any major drops simply because the money flow is still enormous and obligations largely unattractive.

There are a few things to watch out though if any EU country will have a vote against the Euro I expect a major drop in these markets also more aggressive rate increases by the Fed or the ECB might send stocks diving. Another concern is that we might already be in a small bubble we have not seen a real down turn at least in the us since the housing bubble burst which makes me a bit more cautious. On the other hand we saw a lot of corrections during the last year starting with the chines market slide and ending with the trump presidency.

Now generally this year i expect Banks to do pretty well, I m sure that trump is gonna be more lenient with capital requirements then what was proposed or installed now so that banks profitability will go up again. Here my pick for this year would be Wells Fargo, Boa or a CS or UBS most of them already are treading higher then befor Trump and i expect them to keep on doing well this year. I would leave out European banks though other then Deutsche simply because the Euro is gonna lose against the dollar this year. Deutsche i would feel some what comfortable simply because they re still rather low from the blow they took last year, but it is a riskier pick then the before mentioned banks.

One of my favorite picks for this year is Nintendo even though they are still on a slight high from when pokemon go got released. You ask why nintendo? Pretty simple imho in terms of fan fare their the closest thing to apple their is. I mean basicaly all their recent releases broke records. They have a big fan base who would almost buy anything that has the name nintendo on it. Yes the mario app got harsh critics and the retro nes hardly makes a difference to their financials, but i m sure they ll figure out the monetization on their mobile app and the fact stands that there was a run on most of their recent releases heck i still dont have my retro nes. On top of that they got a new console in the pipe line which i think is gonna sell very well. Imho it s the perfect gaming station for a family and also anybody under 16 I mean you ll be able to play all the amazing Nintendo classics and on top of that most other games with decent graphics, which was not the case with the wii. Plus like i said bevore al the nintendo fans of which there are quite a lot are gonna buy the new console just like most hardcore gamers so i really think the new nintendo console will end up with great sellig figures which will also bee seen in the stock price.

That being said if you buy that stock i would recomend that you buy it in your currency or in USD to eliminate the currency risk.

Two other stocks that i feel are currently still underprised are Facebook and CRM they both like most silicon valley companies took a big dive after the trump election which imho we re not justified. We could kind of see that since bothe have already bounced back a bit from the hit they took. I would stil see them as a buy since IMHO FB will reach 135 and probably even crack that 140 mark this year just like i expect CRM to establish it s price above 80.

My favourit though especially for ore casual investor Berk-B its just buffet being buffet the nice thing about this stock is that through owning it you already get a nice diversification since the investments range from Insurance to energy to consumables companies. And imho the only thing to worry about is that the stock will probably take a big dive once warren is gone and at his current age of 86 will have to start thinking about this risk.

I also still like NXP semiconductors had a huge upside last year but again cooled down towards the end of the year. Why do i still like this stock? Quite simple they produce a chip that is in most smart watches so as long as the sale of smart watches and even smart wristbands (like in disney world) keeps on increasing they will be selling a shit ton of chips. Now even though i think smart watches are stupid i dont see this trend stopping just yet.

So these are what are my more conservative picks. Now lets move on to the more adventourose ones. Actually let me add swissquote for anybody haveing access to the swiss markets i would recommend Swissquote (SQN) probably my favourite banking stock out there right now.

Now to the more risky picks I really started to like twitter. Even though i think it kind of is a shitty run company the potential is enormous especially now that we have a president using twitter as one of his main means to communicate. Here s the thing while i dont see twitter all of a sudden coming up with a profitable business model i also dont see them not getting bought up by any of the tech giants if they keep on slumping around at 15/18$. I m sure FB google and even Amazon and probably some more traditional media houses are interested in Twitter and i m sure who ever buys it will have to pay a significant premium. Bottom line twitter became too important to just let them go bust and i expect a takeover within the next two years.

GPRO baisically same as twitter a shitty run company the only difference is that Gpro actually has a god product. I feel like the 9$ the get traded for atm is quite fair even though their P/E multiple is still very high I fell like this is mainly due to the huge flop they had with their drones. If you would take last years figures just from the camera selling business they would stand at an P/E ratio of about 15 which is slightly above industry average and still fairly priced. Now while i expect the price to still drop maybe even to the low 8$ I think if they sort out their Drone business they could easily go back to 10$ per share maybe even as high as 12 if the drone business actually starts taking of so there is a nice upside to it. Another positive thing is the Gpro still has unique knowledge within the action camera section and the value of the brand aloe is pretty big so also there if the price keeps on dropping i expect a takeover sooner rather then later which would give existing investors a nice profit even if they got in at 9$ and took some loss initially.

Note all the stocks i mentioned above are/were in my or one of the portfolios i manage. The ones mentioned are the ones i researched last year and are the ones that i m most likely gonna keep or initiate a position within the next 3 Month. I wrote this from the top of my head so if anybody wants more figures and facts i ll gladly provide them.

For the more experienced or adventurous investor there are always options, I had a incredible last year with options and since i think markets are gonna stay pretty volatile there is still a lot of money to be made with options. Anybody trying to get in to options with the current market conditions i would recommend trying a long straddle. Here you buy a put and a call option on the same underlying asset with the same expiration date. The goal is it to find a very volatile stock so then when the stock moves enough the gain from the call will offset the loss from the put or vice versa, this works because your loss is limited to 100% while your gain is not limited. Also if you wanna take even more risk and the stock is volatile enough you might get lucky and be able to sell both the put and the call at a profit. Ofcourse the risk is that the stock barely moves and you ll have to take a loss on both positions.

I personally had a lot of luck last year with that strategy and averaged about 65% on 23 long straddles that i did. Keep in mind that options are very risky and that you should only invest a small percentage of your portfolio into options. I for example have around 10% of my portfolio in options but with my clients I usually have a max of 5% invested in options unless he specifically asks me to take more risks.

I also wanted to say on the dividend thing it should not matter to you as an investor if you get dividends or not simply because if you dont get your money in dividends you ll get it as a capital gain so unless you think the company will reinvest the money badly there is no reason to prefer dividend yielding stocks.

From a tax perspective non dividend paying stocks are actually better then dividend paying stocks in most countries. Because you ll have to pay taxes on dividends once you get them but you dont have to pay dividend on non realized capital gains so you should be better of with the non dividend paying model. Ofcourse if the dividends you receive equals exactly the cash flow you need anyways and you cant be bothered selling of stocks every year to maintain your CF then dividends might be the way to go but in general you should not prefer one stock to another simply because it s paying out dividends.

Anyways generally speaking and for all the beginners the most important thing is diversify, dont invest into things you dont understand and never buy something because of hear say and you guys should do fine. Also when evaluating a company never forget to look at the management team, Which is arguably the most important. Let me put it like that a company with a shitty product but great management is way more likely to make it then a company with a great product but shitty management. Also before initiating a position make sure you check the short interest on the stock cos this imho give a very god picture on how the market views the stock.

Also i could not agree more with crzdcolombian on apple and just like him i used to be a huge fan boy and even held the stock till after they released their first watches. No new products in the pipline no innovation what so ever imho they are only living of the brand name and the hype but in the tech world that usually does not last if your product are not up to date. I have actually been playing with the thought of shorting apple but i feel like that s still a highly risky move.

- - - Updated - - -

Why do you want to invest in big companies? On IBM on a quick glance they look solid none of their ratios look alarming and they had a solid year last year. What bothers me there is that they are already rather on the high side at 166 and i dont think they ll break through 170 any time soon. Also their short interest rose quite a bit over the last couple of months for such a big company which also suggest that the market sees them rather on the high side ATM. Of course for a final assessment more research would need to be done. From the huge companies in tech i Would prefer Amazon Google Facebook and even Salesforce atm. Other than that Banks and insurers should have a good year if Trump does loosen up the rules they have to follow atm.

For most people it s not possible to invest 400 and lose more then the Invested 400. Usually the instruments which could lead to such outcomes can not be bought by non professionals. Since most non professionals are just allowed to deal stocks bonds and options. You d most likely have to buy on credit or you have to be dumb in a options deal(excecise the option despite making a loss on them) in order to loose more then the invested money. You would need to sell short or bee involved in some kind of a swap arrangement in order to actually lose more money then what you invested or be on the wrong side of a obligation. And again short selling as well as most of the more complex derivatives cannot be traded by non professionals so you should be safe.

Edit:sorry for the huge post

Generally speaking I expect markets to largely move side ways in this coming year. I dont expect the markets in general to make to big a again or a loss this year. Mainly because the situation in europe is still very unstable and also in the US many investors are still uncertain what a trump Presidency will mean. On top of that the feds interest rate increases was very modest plus the ecb will have to keep it s rate low because of a still struggling Europe so i dont expect any major drops simply because the money flow is still enormous and obligations largely unattractive.

There are a few things to watch out though if any EU country will have a vote against the Euro I expect a major drop in these markets also more aggressive rate increases by the Fed or the ECB might send stocks diving. Another concern is that we might already be in a small bubble we have not seen a real down turn at least in the us since the housing bubble burst which makes me a bit more cautious. On the other hand we saw a lot of corrections during the last year starting with the chines market slide and ending with the trump presidency.

Now generally this year i expect Banks to do pretty well, I m sure that trump is gonna be more lenient with capital requirements then what was proposed or installed now so that banks profitability will go up again. Here my pick for this year would be Wells Fargo, Boa or a CS or UBS most of them already are treading higher then befor Trump and i expect them to keep on doing well this year. I would leave out European banks though other then Deutsche simply because the Euro is gonna lose against the dollar this year. Deutsche i would feel some what comfortable simply because they re still rather low from the blow they took last year, but it is a riskier pick then the before mentioned banks.

One of my favorite picks for this year is Nintendo even though they are still on a slight high from when pokemon go got released. You ask why nintendo? Pretty simple imho in terms of fan fare their the closest thing to apple their is. I mean basicaly all their recent releases broke records. They have a big fan base who would almost buy anything that has the name nintendo on it. Yes the mario app got harsh critics and the retro nes hardly makes a difference to their financials, but i m sure they ll figure out the monetization on their mobile app and the fact stands that there was a run on most of their recent releases heck i still dont have my retro nes. On top of that they got a new console in the pipe line which i think is gonna sell very well. Imho it s the perfect gaming station for a family and also anybody under 16 I mean you ll be able to play all the amazing Nintendo classics and on top of that most other games with decent graphics, which was not the case with the wii. Plus like i said bevore al the nintendo fans of which there are quite a lot are gonna buy the new console just like most hardcore gamers so i really think the new nintendo console will end up with great sellig figures which will also bee seen in the stock price.

That being said if you buy that stock i would recomend that you buy it in your currency or in USD to eliminate the currency risk.

Two other stocks that i feel are currently still underprised are Facebook and CRM they both like most silicon valley companies took a big dive after the trump election which imho we re not justified. We could kind of see that since bothe have already bounced back a bit from the hit they took. I would stil see them as a buy since IMHO FB will reach 135 and probably even crack that 140 mark this year just like i expect CRM to establish it s price above 80.

My favourit though especially for ore casual investor Berk-B its just buffet being buffet the nice thing about this stock is that through owning it you already get a nice diversification since the investments range from Insurance to energy to consumables companies. And imho the only thing to worry about is that the stock will probably take a big dive once warren is gone and at his current age of 86 will have to start thinking about this risk.

I also still like NXP semiconductors had a huge upside last year but again cooled down towards the end of the year. Why do i still like this stock? Quite simple they produce a chip that is in most smart watches so as long as the sale of smart watches and even smart wristbands (like in disney world) keeps on increasing they will be selling a shit ton of chips. Now even though i think smart watches are stupid i dont see this trend stopping just yet.

So these are what are my more conservative picks. Now lets move on to the more adventourose ones. Actually let me add swissquote for anybody haveing access to the swiss markets i would recommend Swissquote (SQN) probably my favourite banking stock out there right now.

Now to the more risky picks I really started to like twitter. Even though i think it kind of is a shitty run company the potential is enormous especially now that we have a president using twitter as one of his main means to communicate. Here s the thing while i dont see twitter all of a sudden coming up with a profitable business model i also dont see them not getting bought up by any of the tech giants if they keep on slumping around at 15/18$. I m sure FB google and even Amazon and probably some more traditional media houses are interested in Twitter and i m sure who ever buys it will have to pay a significant premium. Bottom line twitter became too important to just let them go bust and i expect a takeover within the next two years.

GPRO baisically same as twitter a shitty run company the only difference is that Gpro actually has a god product. I feel like the 9$ the get traded for atm is quite fair even though their P/E multiple is still very high I fell like this is mainly due to the huge flop they had with their drones. If you would take last years figures just from the camera selling business they would stand at an P/E ratio of about 15 which is slightly above industry average and still fairly priced. Now while i expect the price to still drop maybe even to the low 8$ I think if they sort out their Drone business they could easily go back to 10$ per share maybe even as high as 12 if the drone business actually starts taking of so there is a nice upside to it. Another positive thing is the Gpro still has unique knowledge within the action camera section and the value of the brand aloe is pretty big so also there if the price keeps on dropping i expect a takeover sooner rather then later which would give existing investors a nice profit even if they got in at 9$ and took some loss initially.

Note all the stocks i mentioned above are/were in my or one of the portfolios i manage. The ones mentioned are the ones i researched last year and are the ones that i m most likely gonna keep or initiate a position within the next 3 Month. I wrote this from the top of my head so if anybody wants more figures and facts i ll gladly provide them.

For the more experienced or adventurous investor there are always options, I had a incredible last year with options and since i think markets are gonna stay pretty volatile there is still a lot of money to be made with options. Anybody trying to get in to options with the current market conditions i would recommend trying a long straddle. Here you buy a put and a call option on the same underlying asset with the same expiration date. The goal is it to find a very volatile stock so then when the stock moves enough the gain from the call will offset the loss from the put or vice versa, this works because your loss is limited to 100% while your gain is not limited. Also if you wanna take even more risk and the stock is volatile enough you might get lucky and be able to sell both the put and the call at a profit. Ofcourse the risk is that the stock barely moves and you ll have to take a loss on both positions.

I personally had a lot of luck last year with that strategy and averaged about 65% on 23 long straddles that i did. Keep in mind that options are very risky and that you should only invest a small percentage of your portfolio into options. I for example have around 10% of my portfolio in options but with my clients I usually have a max of 5% invested in options unless he specifically asks me to take more risks.

I also wanted to say on the dividend thing it should not matter to you as an investor if you get dividends or not simply because if you dont get your money in dividends you ll get it as a capital gain so unless you think the company will reinvest the money badly there is no reason to prefer dividend yielding stocks.

From a tax perspective non dividend paying stocks are actually better then dividend paying stocks in most countries. Because you ll have to pay taxes on dividends once you get them but you dont have to pay dividend on non realized capital gains so you should be better of with the non dividend paying model. Ofcourse if the dividends you receive equals exactly the cash flow you need anyways and you cant be bothered selling of stocks every year to maintain your CF then dividends might be the way to go but in general you should not prefer one stock to another simply because it s paying out dividends.

Anyways generally speaking and for all the beginners the most important thing is diversify, dont invest into things you dont understand and never buy something because of hear say and you guys should do fine. Also when evaluating a company never forget to look at the management team, Which is arguably the most important. Let me put it like that a company with a shitty product but great management is way more likely to make it then a company with a great product but shitty management. Also before initiating a position make sure you check the short interest on the stock cos this imho give a very god picture on how the market views the stock.

Also i could not agree more with crzdcolombian on apple and just like him i used to be a huge fan boy and even held the stock till after they released their first watches. No new products in the pipline no innovation what so ever imho they are only living of the brand name and the hype but in the tech world that usually does not last if your product are not up to date. I have actually been playing with the thought of shorting apple but i feel like that s still a highly risky move.

- - - Updated - - -

Not Crzd but i m still gonna answerIBM then Crzd? Any large companies worldwide you would recommend?

Also, Can people say invest £400 in a company, and end up losing £1000 on that company, and how?

Why do you want to invest in big companies? On IBM on a quick glance they look solid none of their ratios look alarming and they had a solid year last year. What bothers me there is that they are already rather on the high side at 166 and i dont think they ll break through 170 any time soon. Also their short interest rose quite a bit over the last couple of months for such a big company which also suggest that the market sees them rather on the high side ATM. Of course for a final assessment more research would need to be done. From the huge companies in tech i Would prefer Amazon Google Facebook and even Salesforce atm. Other than that Banks and insurers should have a good year if Trump does loosen up the rules they have to follow atm.

For most people it s not possible to invest 400 and lose more then the Invested 400. Usually the instruments which could lead to such outcomes can not be bought by non professionals. Since most non professionals are just allowed to deal stocks bonds and options. You d most likely have to buy on credit or you have to be dumb in a options deal(excecise the option despite making a loss on them) in order to loose more then the invested money. You would need to sell short or bee involved in some kind of a swap arrangement in order to actually lose more money then what you invested or be on the wrong side of a obligation. And again short selling as well as most of the more complex derivatives cannot be traded by non professionals so you should be safe.

Edit:sorry for the huge post

Last edited:

- Joined

- Aug 2, 2007

- Messages

- 15,200

- Likes

- 2,499

- Favorite Player

- Cryptozo d King

10 years of FIF

10 years of FIF Most Diverse Poster

Most Diverse PosterIBM then Crzd? Any large companies worldwide you would recommend?

Also, Can people say invest £400 in a company, and end up losing £1000 on that company, and how?

If you have a lot of money then IBM is interesting but starting out buying a $150+ stock seems foolish.

Only way to lose $1,000 when you invest $400 is by doing options. Which I said earlier and someone agreed is an idiotic thing to do.

So if I buy $400 worth of stock a $100 stock and it goes to $0 per share then I walk away with $0

I I buy $400 worth of options then I lose what ever the stock decreased + dividends paid

So the $400 let's say that got me a option on 100 shares I do not own. I am putting a option to buy them at a certain price. So I am betting it will increase or decrease by X amount by Y time.

So let's say the Stock is Apple. My $400 give me a option of 10 shares. I think Apple will go from its 120 to 100. Apple actually goes up. I lose the amount I am off plus any divend Apple paid out during that time. There is a way to cover yourself by hedging beats but for the most part stay the fk away from option trading.

- Joined

- May 22, 2004

- Messages

- 10,278

- Likes

- 3,348

- Favorite Player

- Oba

10 years of FIF

10 years of FIFSorry crzd but thats not what an option is atleast thats not what is most commonly known as an option! An option simply gives you the right to purchase or sell a stock at a given price at a given point in the future so the max amount you lose is what you put in. You dont actually lose the dividend it s just that you dont get it because your not invested in the stock directly. But thats a very weird way to look at it especially since you re talking about a put option so you would not invest into that stock directly anyways!

Bottom line you dont lose the dividend you only lose the money you paid for the option. What your talking about is short selling which again your not allowed to do as a simple investor!

Bottom line you dont lose the dividend you only lose the money you paid for the option. What your talking about is short selling which again your not allowed to do as a simple investor!

- Joined

- Jun 19, 2011

- Messages

- 8,307

- Likes

- 5,819

- Favorite Player

- Diego Milito

10 years of FIF

10 years of FIFthanks for these posts and the info, i literally feel so much smarter after reading them..lol

Adriano, i only said big companies because i know crzed is US based, so was assuming 'big' companies would be ones that are also popular in UK. No other reason.

Adriano, i only said big companies because i know crzed is US based, so was assuming 'big' companies would be ones that are also popular in UK. No other reason.

- Joined

- Feb 16, 2013

- Messages

- 4,139

- Likes

- 501

- Favorite Player

- Eriksen

- Old username

- Jrg

Forum Supporter

Forum Supporter 10 years of FIF

10 years of FIFYou think Denmark's is high now but the US is kinda lucky Sanders or Clinton didn't get elected. Sanders wanted 65% Capital Gains Tax, and Clinton 50%.

LOL. Why do you think Sanders mentioned Denmark and Scandinavia as a whole many times as an inspiration?

I like Denmark. Our system works. We have well-educated people. Thats why we don't elect a guy like Trump.

Edit by Han: I removed the bit about the US election. Thanks.

- - - Updated - - -

Great post Adriano. And I completely agree with you both about Apple. It is great to read both you and Crzd as I'm not usually doing much in the US market and therefore don't follow it much.

Last edited by a moderator:

- Joined

- Sep 24, 2014

- Messages

- 13,478

- Likes

- 7

- Favorite Player

- Plusvalenza+

A guy I know recently made this, it's on beta: http://tradersleague.net

Basically a game using the real trade market. It can be fun way to learn the basics.

Basically a game using the real trade market. It can be fun way to learn the basics.

- Joined

- Aug 2, 2007

- Messages

- 15,200

- Likes

- 2,499

- Favorite Player

- Cryptozo d King

10 years of FIF

10 years of FIF Most Diverse Poster

Most Diverse PosterEdit by Han: We have a zero tolerance on politics. This is a warning not just to crzd but to everyone. NO MORE POLITICS! Thanks

Last edited by a moderator:

- Joined

- Aug 2, 2007

- Messages

- 15,200

- Likes

- 2,499

- Favorite Player

- Cryptozo d King

10 years of FIF

10 years of FIF Most Diverse Poster

Most Diverse PosterWell right now regardless of politics how companies stand on Trump for any of his tweets do affect stock price which is a very scary thing as a investor.

Boycott Trump movement-

https://www.google.com/amp/m.huffpost.com/us/entry/us_5835c0a0e4b000af95ed70dd/amp?client=safari

Recent tweeter beef between LL Bean/Trump/and this crazy group

https://www.google.com/amp/mobile.n...a-bean-ll-bean-boycott.amp.html?client=safari

This is political but it's also a very real issue you have to realize if you want to invest in the US. You are 1 tweet away from being boycotted for being endorsed or endorsing the president. You also 1 tweet away from having you stock lose value when he says his drunk or coked out nonsense. US has a president not king but people think he can do anything he wants.

Boycott Trump movement-

https://www.google.com/amp/m.huffpost.com/us/entry/us_5835c0a0e4b000af95ed70dd/amp?client=safari

Recent tweeter beef between LL Bean/Trump/and this crazy group

https://www.google.com/amp/mobile.n...a-bean-ll-bean-boycott.amp.html?client=safari

This is political but it's also a very real issue you have to realize if you want to invest in the US. You are 1 tweet away from being boycotted for being endorsed or endorsing the president. You also 1 tweet away from having you stock lose value when he says his drunk or coked out nonsense. US has a president not king but people think he can do anything he wants.

- Joined

- Jul 13, 2011

- Messages

- 17,585

- Likes

- 1,901

- Favorite Player

- 22IcardiBroHand

- Old username

- DomesticatedPimp

10 years of FIF

10 years of FIFWell right now regardless of politics how companies stand on Trump for any of his tweets do affect stock price which is a very scary thing as a investor.

Boycott Trump movement-

https://www.google.com/amp/m.huffpost.com/us/entry/us_5835c0a0e4b000af95ed70dd/amp?client=safari

Recent tweeter beef between LL Bean/Trump/and this crazy group

https://www.google.com/amp/mobile.n...a-bean-ll-bean-boycott.amp.html?client=safari

This is political but it's also a very real issue you have to realize if you want to invest in the US. You are 1 tweet away from being boycotted for being endorsed or endorsing the president. You also 1 tweet away from having you stock lose value when he says his drunk or coked out nonsense. US has a president not king but people think he can do anything he wants.

this shouldnt be edited, this is spot on. Politics impact stocks, especially when you have a fucking nutjob withs o much power tweeting nonsense. And im really what one would say "republican" or right wing.